Will I be prompted to confirm my payment instructions and recipient details before the transaction is executed?

Where applicable, ICICI Singapore will provide an onscreen opportunity, which will contain information relating to the relevant transaction and recipient details such as protected account to be debited, the intended transaction amount recipient’s account number or name, for you to confirm the payment transaction and the recipient credentials before the relevant payment transaction is executed by ICICI Singapore.

Notices

Important update with reference to Internet Banking- Please note we will be migrating to Digital Token by 27th April, 2020. You will require a Digital Token for all critical transactions and will not be able to use Onekey device anymore. Click Here to know more. For more information, please contact: 8001012553 ( 8 am to 6 pm everyday)

Important update with reference to Service channels-

Effective January 31, 2019, the following services will cease to be offered by ICICI Bank limited Singapore Branch-

- Branch operations at Little India (i.e. 190 Serangoon Road, Singapore 218064)

- Remittance Kiosk services at the following locations-

- 6 Raffles Quay, Singapore 048580

- 190 Serangoon Road, Singapore 218064

- Cash services- Cash acceptance and withdrawal services shall be discontinued at both the branches.

The upcoming changes will not impact your relationship with us in any way. In case you have any concerns, please refer to the FAQ here.

Maintenance

The scheduled maintenance are as follows:

2018

2017

2016

2018

January| Date | Maintenance Period | Services under Maintenance |

| 14 January, 2018 | 1.30 am to 2.30 am & 07.00 am to 08.00 am |

On account of scheduled maintenance activity, Kiosk and Internet Banking remittance service will not be available on January 14, 2018 (Sunday) during maintenance period from 1.30 am to 2.30 am and from 7.00 am to 8.00 am. |

| 20 and 21 January, 2018 | 12.00pm to 8.00pm | Cash remittance, cash deposit and cash withdrawal services will not be available temporarily on 20 (Saturday) and 21 (Sunday) January 2018 from 12.00pm to 8.00pm. We regret the inconvenience. |

| 8 January, 2018 | 03.00 am to 3.30 am | On account of scheduled maintenance activity, Kiosk and Internet Banking remittance service will not be available on January 8, 2018 (Monday) from 3.00 am to 3.30 am. Regular services will resume on January 8, 2018 itself from 3.30 am onwards. |

| Date | Maintenance Period | Services under Maintenance |

| 19 February, 2018 | 3.00 am to 5.30 am | On account of scheduled maintenance activity, Kiosk remittance service will not be available on February 19, 2018 (Monday) from 3.00 am to 5.30 am. Regular services will resume on February 19, 2018 itself from 5.30 am onwards. |

| 9 February, 2018 | 1.30 am to 3.30 am | On account of scheduled maintenance activity, Kiosk and Internet Banking remittance service will not be available on February 9, 2018 (Friday) from 1.00 am to 3.30 am. Regular services will resume on February 9, 2018 itself from 3.30 am onwards. |

| Date | Maintenance Period | Services under Maintenance |

| 21st March, 2018 | 12.30 am to 1.00 am AND 6.30am to 7.00 am | On account of scheduled maintenance activity, Retail Internet Banking service will not be available on March 21, 2018 (Wednesday) from 12:30 am to 1:00 am and 06:30 am to 07:00 am. Regular services will resume on March 21, 2018 itself at other timings |

| 11th March, 2018 | 03.00 am to 07.00 am | eNETS direct debit will not be available during the specified period on account of scheduled maintenance activity. This will impact remittance through internet banking via eNETS direct debit. We apologize for any inconvenience caused. |

| 6th March, 2018 | 1.30 am to 2.30 am | On account of scheduled maintenance activity, Retail Internet Banking service will not be available on March 6, 2018 (Tuesday) from 01.30 am to 02:30 am. Regular services will resume on March 6, 2018 itself from 02:30 am onwards |

| Date | Maintenance Period | Services under Maintenance |

| 23rd April, 2018 | 4.30 am to 5.30 am | On account of scheduled maintenance activity, Remittance services such as Online Remittance and Remittance kiosk will not be available on April 23, 2018 (Tuesday) from 04.30 am to 05:30 am. Regular services will resume on April 23, 2018 itself from 05:30 am onwards |

| Date | Maintenance Period | Services under Maintenance |

| 20th May, 2018 | 10.30 am to 11.30 am and 8.30 pm to 9.30 pm |

On account of scheduled maintenance activity, Retail and Corporate Internet Banking services will not be available on May 20, 2018 (Sunday) from 10.30 am to 11:30 am and from 8.30 pm to 9.30 pm. Regular service will be available at other timings. We apologise for any inconvenience. |

| 17th May, 2018 | 12.30 am to 01.00 am | On account of scheduled maintenance activity, Retail Internet Banking service will not be available on May 17, 2018 (Thursday) from 12.30 am to 01:00 am. Regular services will resume on May 17, 2018 itself from 01:00 am onwards. |

| 17th May, 2018 | 7.30 am to 08.00 am | On account of scheduled maintenance activity, Retail Internet Banking service will not be available on May 17, 2018 (Thursday) from 07.30 am to 08:00 am. Regular services will resume on May 17, 2018 itself from 08:00 am onwards. |

| Date | Maintenance Period | Services under Maintenance |

| 13th June 2018 | 10.30 pm – 11:30 pm | On account of scheduled maintenance activity, Corporate Internet Banking services will not be available on June 13, 2018 (Wednesday) from 10.30 pm to 11:30 pm. Regular service will be available at other timings. We apologise for any inconvenience. |

| 11th June 2018 | 10.30 pm – 11:30 pm | On account of scheduled maintenance activity, Corporate Internet Banking services will not be available on June 11, 2018 (Monday) from 10.30 pm to 11:30 pm. Regular service will be available at other timings. We apologise for any inconvenience. |

| 13th June 2018 | 07.30 am – 8.30 am | On account of scheduled maintenance activity, Retail Internet Banking services will not be available on June 13, 2018 (Wednesday) from 07.30 am to 8:30 am. Regular service will be available at other timings. We apologise for any inconvenience. |

| 13th June 2018 | 00.30 am – 1.30 am | On account of scheduled maintenance activity, Retail Internet Banking services will not be available on June 13, 2018 (Wednesday) from 00.30 am to 1:30 am. Regular service will be available at other timings. We apologise for any inconvenience. |

| Date | Maintenance Period | Services under Maintenance |

| 29th July 2018 | 1.30 am – 4.30 am | On account of scheduled maintenance activity, corporate internet banking will not be available on July 29, 2018 (Sunday) from 1.30 am – 4.30 am. Regular services will resume on July 29, 2018 itself from 4.30 pm onwards. |

| 14th July 2018 | 9.00 am – 1:00 pm | On account of scheduled maintenance activity, retail Internet banking and corporate internet banking will not be available on July 14, 2018 (Saturday) from 9.00 am to 1.00 pm. Regular services will resume on July 14, 2018 itself from 1.00 pm onwards. |

| 6th July 2018 | 10.30 pm – 12:30 am | On account of scheduled maintenance activity, Corporate Internet Banking services will not be available on July 6, 2018 (Friday) from 10.30 pm to 12:30 am on July 7, 2018 (Saturday). Regular service will be available at other timings. We apologise for any inconvenience. |

| 7th July 2018 | 10.30 pm – 12:30 am | On account of scheduled maintenance activity, Corporate Internet Banking services will not be available on July 7, 2018 (Saturday) from 10.30 pm to 12:30 am on July 8, 2018 (Sunday). Regular service will be available at other timings. We apologise for any inconvenience. |

| 6th July 2018 | 10.30 pm – 12:30 am | On account of scheduled maintenance activity, Retail Internet Banking services will not be available on July 6, 2018 (Friday) from 10.30 pm to 12:30 am on July 7, 2018 (Saturday). Regular service will be available at other timings. We apologise for any inconvenience. |

| 7th July 2018 | 10.30 pm – 12:30 am | On account of scheduled maintenance activity, Retail Internet Banking services will not be available on July 7, 2018 (Saturday) from 10.30 pm to 12:30 am on July 8, 2018 (Sunday). Regular service will be available at other timings. We apologise for any inconvenience. |

2017

January| Date | Maintenance Period | Services under Maintenance |

| 15th Jan ,2017 | 12:00 am - 8:00 am | UOB internet banking will not be available in eNETS debit service, eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused |

| 22nd Jan ,2017 | 12.30 am - 10.30 am | Kiosk and Internet Banking remittance services will not be available temporarily on 22nd Jan 2017 from 12.30 am to 10.30 am. Regular services will resume on 22nd Jan 2017 (Sunday) itself from 10:30 am onwards. We regret any inconvenience caused |

| Date | Maintenance Period | Services under Maintenance |

| 21st Feb 2017 | 10.30 pm - 11.30 pm | Internet banking services will not be available temporarily 0n 21st February 2017, Tuesday from 10.30 pm - 11.30 pm. We regret the inconvenience. |

| 12th February, 2017 | 4.00 am - 7.00 am | eNETS direct debit will not be available during the specified period on account of scheduled maintenance activity. This will impact remittance through internet banking via eNETS direct debit. We apologize for any inconvenience caused |

| Date | Maintenance Period | Services under Maintenance |

| 10th March 2017 | 8.30 pm - 11.30 pm | On account of scheduled maintenance activity, Internet banking services will not be available temporarily on 10th March from 8.30 pm to 11.30 pm on . Regular service will resume from 11.30 pm onwards. We apologize for the inconvenience. |

| Date | Maintenance Period | Services under Maintenance |

| 20th May 2017 | 08.30am - 09.15 am | Internet banking services will not be available temporarily on 20th May 2017 (Saturday) from 8.30 am to 9.15 am. We regret the inconvenience. |

| 14th May 2017 | 08.30am - 09.15 am | Internet banking services will not be available temporarily on 14th May 2017 (Sunday) from 8.30 am to 9.15 am. We regret the inconvenience. |

| Date | Maintenance Period | Services under Maintenance |

| 25th June, 2017 | 04.00 am – 07.00 am | eNETS direct debit will not be available during the specified period on account of scheduled maintenance activity. This will impact remittance through internet banking via eNETS direct debit. We apologize for any inconvenience caused. |

| 20 June 2017 | 12.30 am – 1.30 am | On account of scheduled maintenance activity, Internet banking services may experience fluctuation. Regular service will resume from 1.30am onwards. We apologize for the inconvenience. |

| 17th June, 2017 | 12.30 am – 1.30 am | On account of scheduled maintenance activity, Internet banking services may experience fluctuation. Regular service will resume from 1.30am onwards. We apologize for the inconvenience. |

| Date | Maintenance Period | Services under Maintenance |

| 10th July, 2017 | 02.00 am to 08.00 am | UOB Internet banking will not be available in eNETS debit service, eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused. |

| Date | Maintenance Period | Services under Maintenance |

| 22nd August, 2017 | 1.00 am to 1.30 am | On account of scheduled maintenance activity, Internet banking services may experience fluctuation. Regular service will resume from 1.30 am onward. We apologize for the inconvenience caused. |

| 15th August, 2017 | 3.00 am to 3.30 am | On account of scheduled maintenance activity, Kiosk remittance service will not be available on August 15th, 2017 from 3.00 am to 3.30 am. Regular services will resume from 3.30 am onwards. We regret any inconvenience caused. |

| Date | Maintenance Period | Services under Maintenance |

| 8th September 2017 | 1.30 am to 2.30 am | On account of scheduled maintenance activity, Kiosk and Internet banking services may experience fluctuation on 8th September 2017 (Friday). Regular service will resume from 2.30 am onward. We apologize for the inconvenience caused. |

| 9th September 2017 | 7.00 am to 8.00 am | On account of scheduled maintenance activity, Kiosk and Internet banking services may experience fluctuation on 9th September 2017 (Saturday). Regular service will resume from 8.00 am onward. We apologize for the inconvenience caused. |

| Date | Maintenance Period | Services under Maintenance |

| 21st October, 2017 | 01.30 pm – 05.30 pm | On account of scheduled maintenance activity, Corporate Internet Banking services may experience fluctuation. Regular service will resume from 5.30 pm onwards. We apologize for any inconvenience caused. |

| 13th October, 2017 | 02.30 am – 09.30 am | On account of scheduled maintenance activity, downloading of e-statements will not be available vide Internet Banking. However, other services will still be available. We apologize for any inconvenience caused. |

| 13th October, 2017 | 00.00 am – 05.30 am | UOB internet banking will not be available in eNETS debit service, eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused. |

| 9th October, 2017 | 03.00 am – 05.00 am | UOB internet banking will not be available in eNETS debit service, eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused.. |

| 8th October, 2017 | 12.00 am – 2.00 am | DBS internet banking will not be available in eNETS debit service, eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused. |

| 1st October, 2017 | 2.00 am – 5.30 am | On account of scheduled maintenance activity, Internet banking services may experience fluctuation. Regular service will resume from 5.30 am onwards. We regret any inconvenience caused. |

| Date | Maintenance Period | Services under Maintenance |

| 20th November, 2017 | 03.00 am to 05.00 am | UOB internet banking will not be available in eNETS debit service, eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused. |

| 13th November, 2017 | 02.30 am to 07.30 am | Kiosk and Internet Banking remittance service will not be available on 13th Nov 2017 (Monday) from 2.30 am to 7.30 am. Regular services will resume on 13th Nov 2017 itself from 7.30 am onwards. We apologize for any inconvenience caused. |

2016

January| Date | Maintenance Period | Services under Maintenance |

| 15th Jan ,2017 | 12:00 am - 8:00 am | UOB internet banking will not be available in eNETS debit service, eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused |

| 22nd Jan ,2017 | 12.30 am - 10.30 am | Kiosk and Internet Banking remittance services will not be available temporarily on 22nd Jan 2017 from 12.30 am to 10.30 am. Regular services will resume on 22nd Jan 2017 (Sunday) itself from 10:30 am onwards. We regret any inconvenience caused |

| Date | Maintenance Period | Services under Maintenance |

| 16th December, 2016 | 6.30 am - 7.30 am | Internet banking services will not be available temporarily on 16th December 2016, Friday from 6.30 am - 7.30 am. We regret the inconvenience. |

| 15th December, 2016 | 10.30 pm - 11.30 pm | Internet banking services will not be available temporarily on 15th December 2016, Thursday from 10.30 pm - 11.30 pm. We regret the inconvenience. |

| 12th December, 2016 | 12.30 AM to 8.30 AM | Kiosk and Internet Banking remittance services will not be available temporarily. Please note that regular services would resume on December 12, 2016 (Monday) itself after 08:30 am onwards. We regret any inconvenience caused. |

| Date | Maintenance Period | Services under Maintenance |

| 26th November, 2016 | 2:00 AM to 3:00 AM | DBS internet banking will not be available in eNETS debit service eNETS Debit service is still available during the period for customers using Internet Banking accounts from other banks. We apologize for any inconvenience caused. |

Applicable from October 10, 2016

Applicable from February 01, 2016

Applicable from October 01, 2013

Applicable from January 11, 2013

Applicable from February 16, 2012

Applicable from September 30, 2010

Applicable from January 15, 2018

HiSAVE

Historic versionInternet Banking

Historic version

General Terms and Conditions for Internet Banking Section A wef from October 01, 2013

General Terms and Conditions for Internet Banking Section A

Forward Plus

Send money to India and be part of a conversation with M.S. Dhoni!

- First 5 customers remitting more than SGD 100,000 in one single transaction will get one pass each to attend this event

- Only customers holding an account with ICICI Singapore are eligible to participate in this offer

- This offer is applicable for remittances undertaken via branch channel only and for the duration of the offer period - December 21 2017 – January 19th 2018

- The same is applicable on a single remittance only made during offer period

- The offer will be applicable on a first come first serve basis

- In case of two or more remitters remitting at the same time, both customers will get passes for the event

- The said offer cannot be exchanged with anything else or encashed and cannot be clubbed with any other offer or promotion offered by the branch, from time to time

- Any dispute in relation to the said offer shall be subject to the jurisdiction of courts in Singapore and governed by laws of Singapore. The terms of the said offer may be changed by branch at any time. The branch makes no representation on the organization or quality of event.

- The branch has the right to withdraw the offer at any time

- Promotional Campaigns

Remit SGD 1000 or more and stand a chance to win 2 free return tickets to India. TnC Apply. Know More

Internet banking - Transaction facility has been discontinued effective November 30,2020

What are the various transaction limits on Internet banking?

The following transaction limits are applicable on Internet banking:

| S.no | Transaction Type | From Account | To Account | Currency | Maximum Limit in currency units | Frequency |

|---|---|---|---|---|---|---|

| 1. | Fund transfer | ICICI Current Account | Account with any bank in Singapore | SGD | 50,000. | Daily* |

| 2. | Fund transfer | ICICI Savings Account | Self current account with ICICI Bank | SGD | 249,999 | Daily* |

| 3. | Fund transfer | ICICI Current Account | Current Account within ICICI Bank SGD | SGD | 50,000 | Daily* |

| 4. | Fund transfer | Hisave savings account | Linked account of Hisave with any other bank in Singapore | SGD | 50,000 | Daily* |

| 5. | Remittance to India | ICICI Current Account | Registered payee with any Bank in India | SGD,USD | 25,000 | Daily* |

What are the Branch codes for ICICI Bank?

The following branch codes are applicable for ICICI Bank Singapore:

| S.no | Branch Name and Address | Branch Code | SWIFT code | Currency | Category |

|---|---|---|---|---|---|

| 1. | Raffles Quay –6 Raffles Quay, #01-02,Singapore-048580 | 8871 | ICICSGSGXXX | SGD | Retail Banking |

| 8872 | USD,AUD,EUR | ||||

| 2. | 190 Serangoon Road Singapore 218064 | 8873 | SGD | ||

| 8874 | USD,AUD,EUR |

| S.no | Others | Code | Swift Code | Currency | Category |

|---|---|---|---|---|---|

| 3. | Private Banking Customers | 8881 | ICICSGSGXXX | SGD | Private Banking |

| 8882 | All currencies except SGD |

When does the fund transfer limit get reset?

Daily Funds Transfer limit for a particular day is reset at 12:00 AM Singapore time.

Can I change my fund transfer limit?

Yes you can modify the limit to a value lower than what is offered by the bank using the “Update transfer limits” tab and following instructions online.

What are the various transaction codes?

The various transaction codes that reflect in your statement are as follows:

| S.no | Transaction Type | From Account | To Account | Narration format | Sample Narration |

|---|---|---|---|---|---|

| 1. | Fund transfer | ICICI Current Account | Account with any bank in Singapore | BIL/12 digit trans action reference number/Date and time /SW | Transaction reference number is 145 executed on 24 October 2012 the narration will be -BIL/000000000145/24-10-2012 17:40:54/SW |

| 2. | Fund transfer | ICICI Savings Account | Self current account with ICICI Bank | TRTR/12 digit trans action reference number/Date and time /SW | Transaction reference number is 178 executed on 24 October 2012 the narration will be - TRTR/000000000178/24-10-2012 17:40:54/SW |

| 3. | Fund transfer | ICICI Current Account | Current Account within ICICI Bank SGD | SWY/Remarks | Remarks set as - Savings SWY/Savings |

| 4. | Fund transfer | Hisave savings account | Linked account of Hisave with any other bank in Singapore | SWY/Remarks | Remarks set as - consolidated SWY/consolidated |

| 5. | Remittance to India | ICICI Current account | Registered payee with any Bank in India | IRM/FIO8 digit transaction reference number/REM/Date and time | Transaction reference number is SRI01234567 executed on 2 Feb 2012 the narration will be -IRM/FIOSRI01234567 /REM/20120210124224 |

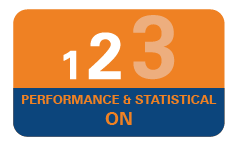

What kind of transaction signing is applicable on my fund transfers?

The transaction signing required for a transaction depends on the amount that you are transferring. Please be guided by the grid below-

Local Fund transfer

| S.no | Transfer Amount | Type of verification applicable |

|---|---|---|

| 1. | From 1 to less than 2001 | Onekey device based OTP |

| 2. | From 2001 to less than 25001 | Transaction signing password using Onekey device with one input parameter |

| 3. | From 25001 to less than equal to 50000 | Transaction signing password using Onekey device with two input parameters |

Remittance to India

| S.no | Transfer Amount | Type of verification applicable |

|---|---|---|

| 1. | From 1 to 2000 | Onekey device based OTP |

| 2. | Greater than 2000 and less than 25000 | Transaction signing password using Onekey device with one input parameter |

What is the GIRO upgrade about?

This is an industry wide enhancement of the current interbank GIRO payment infrastructure led by the Association of Banks in Singapore (ABS).

What are the benefits of this upgrade?

The benefits that are available after the upgrade are:

- Ease of setting up payment instructions without the need for a bank branch code

- Introduction of new Purpose code and Reason codes

- Ability to pay credit or charge cards with other banks

- Greater clarity of payment instruction in bank statements

Will my bank account number be changed?

Your bank account number will not be changed. However when you are adding payee for fund transfer please note that for HSBC, OCBC and State Bank of India (SBI), you will need to incorporate the branch into the account number field after the upgrade. The full account number will be expanded to include the branch code followed by the existing account number for these 3 banks, please remember to use the new account number going forward.

See below for an example:

| Bank Name | Current | Post Upgrade | |||

|---|---|---|---|---|---|

| Bank Code | Branch Code | Account Number | SWIFT/BIC | Account number | |

| HSBC | 7232 | 146 | 12345678 | HSBCSGSGXXX | 14612345678 |

| SBI | 7791 | 277 | 34567891 | SBINSGSGXXX | 27734567891 |

| OCBC | 7339 | 550 | 45678901 | OCBCSGSGXXX | 55045678901 |

| All other banks | NA | NA | 58901234 | SWIFTCode | 58901234 |

Internet banking - Transaction facility has been discontinued effective November 30,2020

How do I perform a FAST transaction?

After logging into your internet banking using Login ID and password, at the Funds Transfer (Interbank Funds Transfer) page, when entering the details of your payment, the FAST option will be available if the beneficiary bank is one of the FAST participating banks. Tick on the box [FAST (Fast and Secure Transfer)], complete the remaining fields and proceed to submit the transaction.

Can I use FAST if I have the payee’s name only and not the account number?

No, the payee’s bank account number is required for FAST transfer.

Why can't I choose FAST for my transaction?

You will not be able to choose FAST if the beneficiary bank is not one of the FAST participating banks.

I have an existing payee where the beneficiary bank is one of the participating banks. Do I still need to create new payee to perform a FAST transaction?

No, if you have already added the designated payee previously; you may simply click on the Fund transfer link to transfer funds to the payee and then select FAST to perform the FAST transaction.

Why do I have to fill in Purpose of Transfer?

The purpose of transfer field is required to be filled in for FAST transactions, and the purpose code that you have selected will be reflected in the account transaction history for each FAST transaction, for your easy reference.

Can I perform a future dated FAST transaction?

Yes.

Can I have a recurring FAST transaction?

Yes. Please note that the start date for any recurring transaction cannot be the same day. The earliest start date is the following day.

I encountered the following error message, what does it mean?

*The selected bank is currently unable to accept FAST transactions. You may choose to use the 3rd Party Funds Transfer service instead which may take 2 - 3 working days. Alternatively, please try again later.

The beneficiary bank is currently unable to accept FAST transactions. You may choose to effect the funds transfer using the 3rd Party Funds Transfer (Interbank Funds Transfer) service, which may take two to three working days. Alternatively, you may try again later.

Important Update

Please note that transfers using kiosk will be disbursed same day to any bank in India subject to operational cut off* effective Nov 24th 2015.

Please note that with effect from 31st January 2019, the Kiosk remittance facility will be discontinued.

Features

- Fund transfers-

- Same day* to any bank in India (subject to satisfactory completion of and compliance with the Bank’s standard procedures)

- Competitive and Confirmed exchange rates

- Touch screen at the KIOSK for ease of use

- Round the clock availability of money transfer service

- Funding through NETS debit card is available

- Minimum service charge

- You would need to register for the KIOSK Service by visiting ICICI Bank Limited, Singapore Branch ("Branch") with the documents needed in order to remit money by using this KIOSK Service

- You can also transact at the time of registration and the beneficiary shall become a registered beneficiary at the KIOSK for subsequent transactions

- Additional beneficiaries can be added at the KIOSK. Please note registration of the beneficiary would take 24 hrs* post submission of request on the KIOSK

- You can transfer money through the KIOSK Service to successfully registered beneficiaries

- Fund transfer** to

- Beneficiaries with account at any bank in India - Same day***

- You will get a receipt on successful completion of money transfer

- *24 hrs- Excluding public holidays and non-working day in Singapore

- **Funding for the money transfers can only be done by NETS enabled debit cards

- ***Same day fund/ money transfers are subject to cut off timings, presently 4:00 PM, SGT (subject to satisfactory completion of and compliance with the Bank’s standard procedures)

- Documents needed-

- Simply walk into the Branch and submit a KIOSK registration & Transaction form along with your funds by way of NETS debit card

- Carry your NRIC Card or carry any other form of ID proof like your passport, EP along with your latest Address Proof (less than three months old)

- Do not enter your Personal Identification Number ("PIN"), when someone else can see you keying it in.

- When entering your PIN, use your hand to shield your PIN number from being revealed.

- Always conduct your transactions yourself. Do not lend your card or disclose they PIN to anyone, including family, friends and people claiming to be bank employees.

- Change your PIN regularly.

- Beware of any suspicious objects attached to the kiosk that make its appearance or operation seem unusual (for example, those that retain your card for no good reason).

Security tips for performing transaction at Remittance Kiosk

* Same day fund/ money fund transfer are subject to cut off timings, presently 4:00 PM, SGT (subject to satisfactory completion of and compliance with the Bank’s standard procedures)

How to Use Kiosk

Syndicated Loan allows corporates to avail of the best foreign currency credit opportunities through a host of instruments.

International Syndication Group (ISG) acts as arranger / underwriter for a variety of loans across the risk spectrum. These include:

- M & A financing - Strategic & financial sponsor driven acquisitions;

- Asset backed financing - Aircraft, oil rigs, shipping, offshore support vessels;

- Project financing - Airports, oil and gas, power, roads, ports, telecom, mining, real estate;

- Structured finance - High yield mezzanine / equity linked debt

- Corporate lending - External Commercial Borrowing for refinancing / capital expenditure.

ISG is a dominant player for India linked loans in both the primary and secondary loan distribution market.

Credentials:

- A leader in the offshore syndicated loan market from India; - No. 2 Bookrunner for the India Offshore Loans market (CY 2012);

- Cumulative deal volume of over USD 30 billion, since 2007;

- Strong relationships with banks and funds, operating across sectors, globally;

- A dedicated and experienced team covering markets in Asia, Europe and the Middle East.

Key Transactions in FY 2013:

- USD 425 million project financing for an Indonesian mining services company

- USD 270 million financing for one of the largest education groups in India

- USD 221 million non-fund based facility to a Korean Company for power project in India

- USD 124 million loan for setting up a BOPET manufacturing unit in Bahrain, GCC Region

- USD 85 million multi-currency project financing for setting up an IB curriculum school in Singapore.

A comprehensive range of services to meet all aspects of Export and Import financing.

ICICI Bank offers an entire gamut of trade finance services to cover your trade finance needs. This includes both Export & Import finance and Guarantees. Our client philosophy is to provide premium quality service by offering the widest array of choices supplemented by world-class products.

In our trade services division, our business is built such that our technology leadership meets client's needs. This philosophy has resulted in our bank being recognised by the, Global Finance Award for the "World's Best Trade Finance from India" for 2006.

ICICI Bank offers a wide range of trade services designed to assist you in building on your strengths. Routing your transactions through ICICI Bank would eliminate many of your hassles. With our expertise and experience, we can structure and customize solutions for your specific requirements.

A full suite of innovative Corporate Finance products designed to fulfil all requirements of the fast growing corporate.

Harnessing new technologies and thought processes

ICICI Bank has harnessed new technologies and thought processes to introduce numerous products and services in the area of Corporate Finance to suit various clientele. The products can be broadly classified into:

- Demand Loan

Short-term loans to meet working capital requirements. - Revolving Credit Facility (RCF)

Committed facility for a fixed period and available for drawing at any time before the final expiry date. - Term Loan (fixed or floating)

Credit facility to meet medium to long-term fund requirements. - Bridge Loan

Short-term credit facility to meet temporary fund requirements.

Overdrafts

We offer overdraft facility against the security of Fixed Deposits, and can be attached to an existing / new Current Account. (Also see Premium Account)

Overdraft is a standby line where interest is charged only on the amount used in the credit line and there is no need to uplift your Fixed Deposit when there is a need for cash. The facility can also be drawn in a currency other than the deposit currency.

Demand Loan

We offer short-term loans to meet your working capital requirements. This is an advance for specific periods of one year or less where amounts repaid may be re-borrowed, at the Bank's discretion. It is repayable on demand. Interest payments and principal repayments are made at the end of each advance, or the principal can be rolled over with a new contracted rate.

Revolving Credit Facility

We offer revolving credit facility to meet your working capital requirements. RCF is a committed facility for a fixed period and is available for drawing at any time before the final expiry date. RCF would be useful for meeting your short term needs and could also act as a source for your long-term working capital. We offer the facility for a wide range of tenure from 3 months to 5 years.

Interest payments and principal repayments are made at the end of each advance or the principal can be rolled over with a new contracted rate. A commitment fee applies.

Term Loan (fixed or floating)

We offer term loans to meet your medium to long-term fund requirements. This is an advance granted by the bank for a fixed term of more than one year. It is a non-revolving facility with a pre-determined expiry date. The facility is a committed facility and a commitment fee applies on the undrawn amount. Amount once repaid cannot be redrawn. The interest rate can be variable, pegged to a base rate or fixed upfront.

Receivables Financing or Factoring

We offer factoring as an alternate means of raising working capital finance. Factoring involves the financing of accounts receivables. You can raise working capital by selling the accounts receivable to the Bank. We would grant an advance based on the amount of accounts receivables and your customers will settle the accounts receivables by paying directly to the Bank. Beside the accounts receivables, no other collateral is required.

We offer two variants:

- With recourse financing: We offer advance against the security of the accounts receivable and hence the amount would appear as a loan in your book. You would be liable to repay the advance if your customer does not make the payment.

- Without recourse financing: We would purchase the receivables from you and they would no longer appear on your book. We would have no recourse to you if your customer defaults in payment.

Bridge Loan

We offer short-term credit facility to meet temporary fund requirements. A bridging facility (e.g. Bridging Overdraft, Bridging Term Loan, etc.) is a temporary facility for a specific purpose, which will be refinanced by another facility to be granted by either the Bank or another financial institution, or a readily identifiable source of funds.

We at ICICI Bank Singapore Branch care for your financial needs and have taken our first step towards helping you live your life worry free!

Yes, we have partnered with Aviva Financial Advisers* to carry out referral activities to prospective customers for insurance or investment products distributed by them.

- Life Insurance

- Health Insurance

- General Insurance

- Group Insurance

- Investment-linked products

- Unit Trusts

The range of products which we facilitate through Aviva Financial Advisers includes:

So what are you waiting for? Just walk into any of our branches and ask an ICICI Bank Executive for a referral to Aviva Financial Advisers today or simply request a call back!

*Terms and conditions apply. The Insurance & Investment products mentioned herein are not products of ICICI Singapore and are distributed by Aviva Financial Advisers Pte Ltd. ICICI Singapore has an exclusive introducer agreement with Aviva Financial Advisers Pte Ltd, a wholly owned subsidiary of Aviva Ltd.

You can use Internet Banking to:

- View your account balance, transaction history and account details.

- View details of the deposit(s) you hold with us

- Download your statement (upto 1 year old)

- Initiate requests to transfer money to India (using your SGD or USD current accounts)

- Initiate fund transfer within Singapore (using your SGD current accounts)

FAST (Fast And Secure Transfers) is a new electronic funds transfer service that enables customers to transfer SGD funds almost immediately from one participating bank to another in Singapore.

No, FAST only enables funds transfer between accounts of the 19 participating banks in Singapore. Funds between a participating and a non-participating bank may be transferred via Interbank GIRO.

FAST is secure and adopts the same security standards established by the banking industry in Singapore for funds transfers.

Effective Feb 5th 2018 using FAST you can-

- Receive upto SGD 200,000

- Send upto SGD 50,000

However, please note that the maximum amount you may send out in a day is still subject to your current personalized daily limit, which may be lower.

Yes. Please note that the start date for any recurring transaction cannot be the same day. The earliest start date is the following day.

There are 4 types of transaction status:

- Submitted - Payment instruction has been received but not processed.

- Successful - Payment is successful.

- Rejected - Payment is unsuccessful.

- Scheduled - Payment instruction has been received for payment to take place on a future date.

It contains:

- the payment name FAST;

- the 4-character code for the purpose of the transfer;

- Rejected - Payment is unsuccessful.

- the beneficiary account number; and

- the remarks entered.

The FAST transaction that you have performed has been rejected by either the beneficiary bank or the FAST operator. Hence the transaction has been reversed.

The reason for the rejection will be notified to you via a message sent to your online banking mailbox.

Please contact the Bank, and provide us with the following information:

- Transaction receipt number,

- Debiting Account number,

- Amount

- Receiving Bank and

- Receiving Account Number